If you’ve ever found yourself pondering the perplexing question of dental insurance versus dental savings plans, fear not! I’m here to shed some light on this dental dilemma and help you figure out what’s best for you. You see, navigating the world of dental benefits can be as tricky as trying to floss with your eyes closed. But worry not, my friend, I’ve got your back!

Now, let’s dive into the deep waters of dental insurance. Picture this: you’re swimming in a sea of premiums, deductibles, and copayments. It can feel like a never-ending tide of paperwork and restrictions. But hey, dental insurance does have its perks. It can provide coverage for routine check-ups, cleanings, and even some major procedures. However, like a hidden reef, there are limitations to be aware of. Waiting periods, annual maximums, and pre-existing condition exclusions can leave you feeling like you’re swimming against the current.

But wait, there’s another option on the horizon! Enter dental savings plans, the sun-kissed shores of affordable dental care. These plans work differently than insurance, more like a membership at a beach club. You pay an annual fee and gain access to discounted rates at participating dentists. No waiting periods, no deductibles, just straightforward savings. It’s like catching a wave of affordability that can leave you with more cash in your beach bag at the end of the day.

So, my friend, whether you choose the depths of dental insurance or ride the waves of dental savings plans, the choice is ultimately yours. Just remember to weigh the pros and cons, consider your dental needs, and make a decision that keeps your smile shining bright. Now, let’s embark on this dental adventure together and find the best option for you!

When it comes to choosing between dental insurance and dental savings plans, it’s important to consider your specific needs and financial situation. Dental insurance typically involves monthly premiums and coverage limitations, while dental savings plans offer discounted rates on dental services for a yearly fee. If you prioritize comprehensive coverage and don’t mind the higher costs, dental insurance may be the better option. However, if you’re looking for more affordable dental care and flexibility, a dental savings plan could be the best choice. Ultimately, it’s crucial to evaluate your individual needs and compare the benefits and drawbacks of each option.

Dental Insurance vs. Dental Savings Plans: What’s Best for You?

When it comes to dental care, many people find themselves wondering whether dental insurance or dental savings plans are the better option for them. Both options have their advantages and disadvantages, and it’s important to understand the differences between the two before making a decision. In this article, we will explore the pros and cons of dental insurance and dental savings plans, so you can make an informed choice about what’s best for you.

The Basics of Dental Insurance

Dental insurance is a type of coverage that helps pay for dental expenses. It typically works by requiring you to pay a monthly premium in exchange for coverage on a variety of dental services. Dental insurance plans often have a deductible that you must meet before the insurance starts covering costs, and they may also have annual maximums that limit the amount of coverage you can receive in a given year.

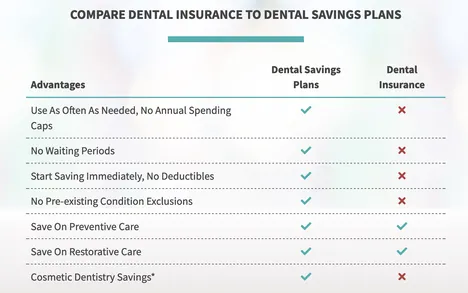

One of the main benefits of dental insurance is that it can help reduce out-of-pocket costs for routine and preventive dental care, such as cleanings and check-ups. However, dental insurance often has limitations and restrictions, such as waiting periods for certain procedures and exclusions for pre-existing conditions. Additionally, dental insurance may not cover cosmetic procedures or treatments deemed unnecessary by the insurance provider.

The Advantages of Dental Savings Plans

Dental savings plans, on the other hand, operate differently than dental insurance. Instead of paying a monthly premium, you pay an annual fee to become a member of a dental savings plan. This membership gives you access to discounted rates on dental services from participating providers. Dental savings plans do not have deductibles or annual maximums, so you can use the plan as often as needed.

One of the main advantages of dental savings plans is the flexibility they offer. Unlike dental insurance, which may have restrictions on coverage and providers, dental savings plans often have a wide network of participating dentists and specialists. This allows you to choose the dentist you prefer and receive discounted rates on a variety of procedures, including cosmetic treatments that may not be covered by insurance.

The Importance of Regular Dental Care

Regardless of whether you choose dental insurance or a dental savings plan, it’s crucial to prioritize regular dental care. Routine check-ups and cleanings can help prevent dental issues from worsening, saving you time, money, and discomfort in the long run. Regular dental care also allows your dentist to identify and address potential problems early on, reducing the need for more extensive and costly treatments.

By committing to regular dental visits, you can maintain good oral health and catch any issues before they become major problems. Your dentist can provide personalized recommendations based on your unique needs and help you develop a plan for ongoing dental care.

Choosing the Right Option for You

When deciding between dental insurance and dental savings plans, it’s important to consider your individual needs and circumstances. If you have ongoing dental issues or anticipate needing extensive dental work, dental insurance may provide more comprehensive coverage. On the other hand, if you prioritize flexibility and want to save money on a variety of dental services, a dental savings plan may be the better choice.

It’s also worth noting that dental insurance and dental savings plans are not mutually exclusive – some people choose to have both to maximize their coverage and savings. Ultimately, the best option for you will depend on factors such as your budget, dental needs, and personal preferences.

In conclusion, dental insurance and dental savings plans offer different benefits and considerations. Dental insurance can help reduce out-of-pocket costs for routine care, while dental savings plans provide discounted rates and flexibility. Regular dental care is essential regardless of the option you choose. By weighing the pros and cons and considering your individual needs, you can make an informed decision about what’s best for you.

Key Takeaways: Dental Insurance vs. Dental Savings Plans: What’s Best for You?

- Dental insurance offers coverage for a variety of dental procedures and treatments.

- Dental savings plans provide discounts on dental services, but do not offer insurance coverage.

- Consider your dental needs and budget when deciding between insurance and savings plans.

- Insurance plans may have higher premiums and deductibles, while savings plans have lower costs.

- Review the coverage and benefits of each option before making a decision.

Final Summary: Making the Right Choice for Your Dental Needs

After comparing dental insurance and dental savings plans, it’s clear that both options have their pros and cons. When deciding which one is best for you, it’s important to consider your specific dental needs, financial situation, and personal preferences.

Dental insurance can provide comprehensive coverage for a wide range of dental procedures, offering peace of mind and protection against unexpected expenses. However, it often comes with high monthly premiums, deductibles, and waiting periods for certain treatments. On the other hand, dental savings plans offer discounted rates on dental procedures and may have lower upfront costs, making them a more affordable option for those without insurance. Yet, they do not provide the same level of coverage as dental insurance and may limit your choice of dentists.

Ultimately, the best choice for you will depend on your individual circumstances. If you have a history of dental issues or anticipate needing extensive dental work in the future, dental insurance may be the better option to ensure comprehensive coverage. However, if you have good oral health and are looking for a more cost-effective solution, a dental savings plan can provide the necessary discounts for routine procedures and preventive care.

Remember to carefully review the terms and conditions of each option, including coverage limits, waiting periods, and network dentists, to make an informed decision. Whether you choose dental insurance or a dental savings plan, prioritizing your oral health is key. Regular dental check-ups and proper oral hygiene practices are crucial for maintaining a healthy smile and preventing potential dental problems down the line.

In conclusion, by understanding the benefits and drawbacks of dental insurance and dental savings plans, you can make an informed decision that aligns with your needs and budget. Remember, your oral health is important, so choose the option that offers the coverage and affordability that works best for you.